Delaware Prosperity Partnership

April 29, 2019

FMC Corporation

April 3, 2019

M&T Commits to Tech Jobs, Other Roles in Delaware

April 3, 2019

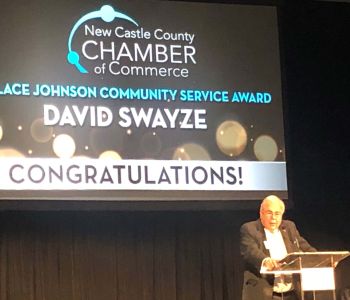

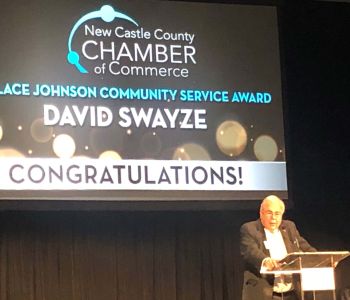

STAR Campus: Innovative, Award-Winning STEM Hub

April 3, 2019

Delaware Looking to Thrive with Private, Public Partnership

April 2, 2019

A Delaware Institution on the Business Benefits of Delaware

March 27, 2019

Join us on April 2nd for an Economic Development Update

March 15, 2019

Millennial-Centric Banking App to Hire 30-50 Industry Vets to Drive Growth

February 25, 2019

Wilmington PharmaTech to Expand in Delaware; Planning New Large-Scale Manufacturing Facility

February 12, 2019

Wilmington Office Buildings’ Internet Certification Could Bring Boost to Downtown

February 4, 2019

Study Sees Big Benefits from Investing in Delaware’s Infrastructure

January 25, 2019

Tata Trusts and New America Launch Blockchain Blueprint